Daily Wonders and Discoveries

Explore the latest news and intriguing insights from around the world.

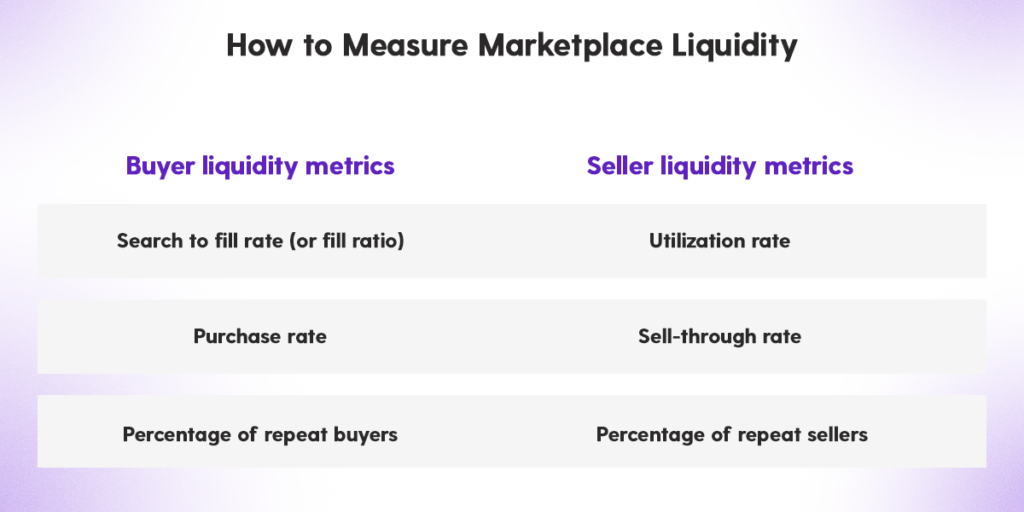

Liquidity Loops: The Secret Life of Marketplace Models

Discover the hidden dynamics of marketplace models! Explore how liquidity loops can boost your business success like never before.

Understanding Liquidity Loops: How Marketplace Models Thrive

Understanding liquidity loops is essential for grasping how marketplace models thrive in the digital economy. At its core, a liquidity loop refers to the continuous cycle of supply and demand that creates a vibrant marketplace. When enough buyers and sellers participate in a platform, a network effect occurs, attracting even more participants. This engagement enables transactions to happen quickly, enhancing user experience and encouraging repeat participation. As more users join, the marketplace becomes increasingly efficient, demonstrating the powerful dynamics of liquidity in driving growth and sustainability.

In effective marketplace models, liquidity loops hinge on two key factors: user engagement and effective matchmaking. Platforms that facilitate seamless interactions between buyers and sellers often implement sophisticated algorithms and features to optimize user experience. For instance, features like user reviews, recommendations, and real-time analytics help build trust and foster connections. As participants experience the benefits of an efficient marketplace, they contribute to the liquidity loop, creating a self-reinforcing cycle that supports long-term success and innovation. Understanding these dynamics can guide entrepreneurs in designing platforms that thrive in competitive landscapes.

Counter-Strike is a highly popular first-person shooter game series where players engage in team-based combat. Players can choose to be part of the terrorist or counter-terrorist teams, completing various objectives to secure victory. For players looking to enhance their gaming experience, using a daddyskins promo code can provide exciting in-game skins and boosts.

The Role of Supply and Demand in Liquidity Loops

The concept of liquidity loops is deeply intertwined with the fundamental economic principles of supply and demand. Liquidity loops occur when the buying and selling of assets create a cycle that enhances market efficiency. In this context, supply refers to the availability of assets or commodities on the market, while demand represents consumer desire or need for those assets. When demand for an asset increases, often due to scarcity or heightened interest, it triggers a liquidity loop. This cycle maintains the price equilibrium and ensures that buyers and sellers can engage without significant price fluctuations.

As liquidity loops are influenced by supply and demand, understanding this relationship is crucial for market participants. When the demand for an asset remains high while the supply diminishes, prices may surge, leading to rapid trading activity—essentially fueling the liquidity loop. Conversely, an oversupply of an asset with stagnant or decreased demand can cause prices to plummet, locking participants in a liquidity trap. Investors and analysts closely monitor these dynamics to predict market behavior and devise strategies that capitalize on emerging trends in the liquidity cycle.

What Are the Key Benefits of Effective Marketplace Liquidity?

Effective marketplace liquidity plays a crucial role in ensuring that transactions occur smoothly and efficiently. One of the primary benefits is reduced transaction costs. When a marketplace is liquid, buyers and sellers can quickly match their orders with minimal price discrepancies, which ultimately lowers the costs associated with trading. This not only encourages more participants to engage in the market but also fosters a competitive environment that can lead to better pricing for consumers.

Another significant advantage of a liquid marketplace is enhanced market stability. With increased buy and sell activity, the market becomes less susceptible to large price swings caused by a limited number of trades. This stability not only boosts investor confidence but also attracts institutional players who seek a reliable trading environment. Additionally, liquidity can help in absorbing shocks during volatile periods, thereby promoting a healthier marketplace.